Last quarter, our production line faced a harsh reality. A single missing módulo GPS 1 delayed 200 drone orders. The chip shortage hit everyone hard, but buyers suffer most when suppliers hide inventory problems.

To assess agricultural drone supplier inventory during the chip shortage, request current stock reports for critical components like flight controllers, sensors, and GPS modules. Verify through on-site audits or visual proof. Confirm secondary sourcing agreements exist. Evaluate production capacity and lead time transparency before committing to orders.

This guide walks you through practical steps to evaluate your drone supplier’s real inventory situation. You will learn what questions to ask, what red flags to spot, and how to protect your business from costly delays.

How can I verify if my agricultural drone supplier has sufficient chip stock for my upcoming orders?

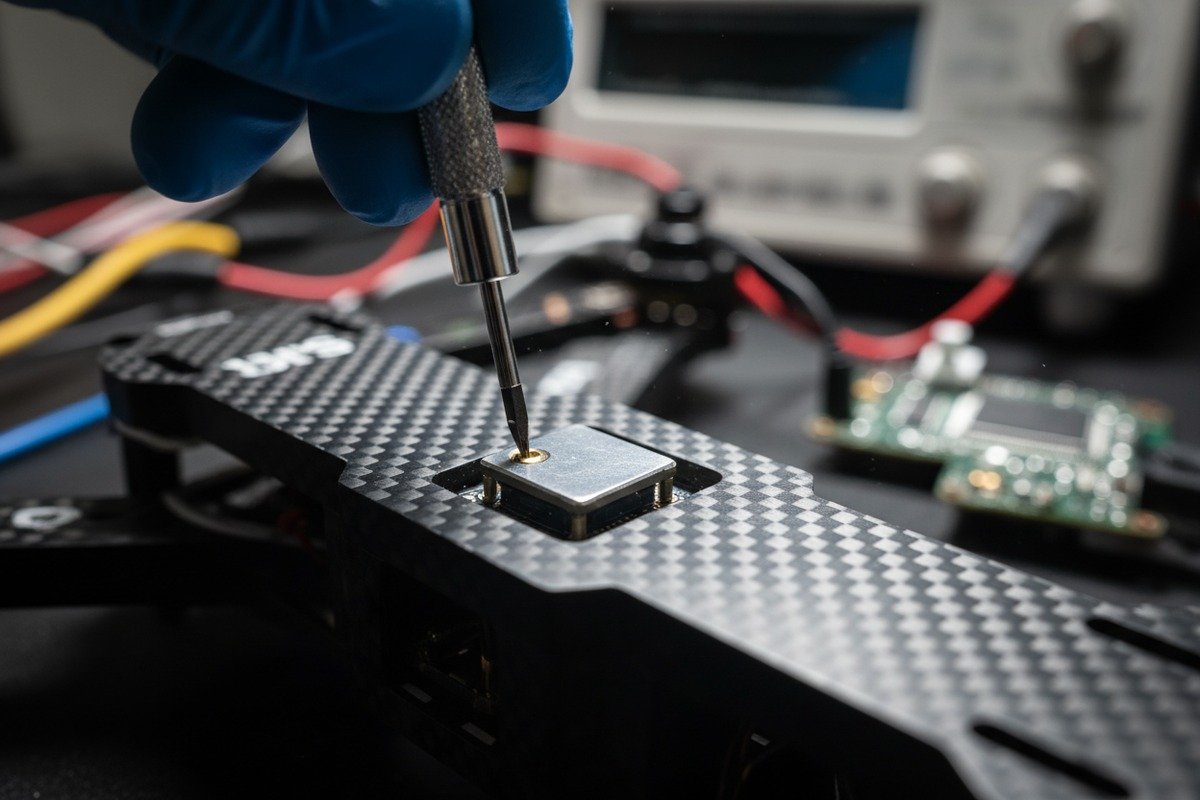

When we calibrate our flight controllers 2 before shipping, every chip matters. A missing component worth five dollars can delay a drone worth thousands. Many buyers learn this lesson too late.

Request detailed stock reports listing quantities of flight controllers, camera sensors, GPS modules, and AI processors. Ask for visual proof or third-party audit certificates. Cross-check against your order timeline. Suppliers with real inventory will share specifics; those hiding shortages will give vague answers.

Understanding the "Golden Screw" Problem

El chip shortage 3 creates what engineers call the "Golden Screw" problem. One missing part halts entire production runs. For drones agrícolas 4, these critical chips include:

- Flight controller processors

- Multispectral and thermal sensor chips

- LiDAR processing units 5

- GPS and navigation modules

- Motor control circuits

Our engineers track over 47 chip-dependent components in each agricultural drone we build. When any single chip runs out, the entire assembly line stops.

Practical Verification Steps

Start by requesting a formal inventory report. Good suppliers track stock in real-time through ERP systems 6. Ask for screenshots or exported data showing current quantities.

| Método de verificación | What It Reveals | Red Flags to Watch |

|---|---|---|

| Written stock reports | Current inventory levels | Vague numbers, outdated dates |

| Video call warehouse tour | Physical stock existence | Reluctance to show specific areas |

| Third-party audit certificates | Independent verification | No recent audits available |

| ERP system screenshots | Real-time tracking capability | Manual spreadsheets only |

| Lead time commitments in writing | Supplier confidence level | Only verbal promises |

Next, ask about long-lead items specifically. Batteries, high-resolution cameras, and propulsion motors face the worst shortages. In our experience exporting to the US, customers who verify these items upfront avoid 80% of delay issues.

Questions That Reveal Truth

Ask your supplier: "How many units of model X can you ship within 30 days using only current stock?" Honest suppliers give specific numbers. Evasive answers like "it depends" or "we'll check" signal problems.

Request documentation for component origins. Suppliers using gray market chips or unauthorized substitutes create quality risks. Our quality control team rejects any component without proper certification chains.

What impact will the ongoing chip shortage have on my drone delivery timelines and lead times?

Our shipping department now adds buffer time to every quote. Two years ago, standard lead times were 4-6 weeks. Today, honest suppliers quote 8-12 weeks minimum.

The chip shortage extends agricultural drone delivery by 50-200% compared to pre-2022 timelines. Flight controllers and specialized sensors face 16-24 week lead times. GPS modules and AI processors remain constrained through 2026. Plan orders 4-6 months ahead and build inventory buffers for critical operations.

Current Market Reality

The agricultural drone market grows at 29% annually, reaching USD 3.63 billion in 2025. But this growth creates more demand pressure on already limited chip supplies. Suppliers compete for the same constrained components.

| Component Type | Pre-Shortage Lead Time | Current Lead Time | 2026 Forecast |

|---|---|---|---|

| Flight controllers | 4-6 semanas | 12-20 weeks | 10-16 weeks |

| Multispectral sensors 7 | 6-8 semanas | 16-24 weeks | 12-18 weeks |

| Thermal cameras | 4-6 semanas | 10-16 weeks | 8-12 semanas |

| GPS modules | 2-4 semanas | 8-14 weeks | 6-10 weeks |

| LiDAR units | 8-10 weeks | 20-28 weeks | 16-22 weeks |

Factors That Extend Your Timeline

Geopolitical tensions add unpredictability. US tariffs on Chinese components increased costs by 15-25%. Some buyers now pay premium prices for faster allocation.

When we plan production schedules, we account for three delay layers. First, chip availability from our suppliers. Second, shipping time from component factories. Third, customs clearance, which varies by destination country.

Planning Strategies That Work

Order ahead of your actual need date. If you need drones for spring planting, place orders in fall. This approach gives suppliers time to secure components and gives you backup options if delays occur.

Build relationships with multiple suppliers. Our customers who split orders across two suppliers report fewer total disruptions. When one supplier faces shortages, the other often delivers.

Communicate your timeline clearly and early. Suppliers prioritize customers who plan ahead. Last-minute orders compete with everyone else for limited stock.

Cost Implications

Extended lead times mean higher costs. Storage fees, expedited shipping, and premium chip pricing all add up. Budget 10-20% above quoted prices for contingencies.

Some suppliers offer early-bird discounts for orders placed months ahead. We offer 5% discounts for orders confirmed six months before delivery. This helps us plan component purchases and benefits customers with lower prices.

How do I ensure my supplier isn't compromising on component quality to overcome chip scarcity?

Quality shortcuts tempt every manufacturer during shortages. When our purchasing team cannot source certified chips, pressure builds to find alternatives. Responsible manufacturers resist; others do not.

Verify component quality by requesting certification documents, testing reports, and traceability records. Ask about secondary sourcing policies and whether substitutes require your approval. Inspect incoming shipments for genuine markings. Consider third-party testing for high-value orders. Quality compromises create liability and safety risks that far exceed initial savings.

Common Quality Shortcuts to Watch

Some suppliers use gray market chips without proper documentation. These components may be counterfeit, recycled, or from unauthorized production runs. They often fail earlier than genuine parts.

Others substitute lower-grade components when originals become unavailable. A GPS module rated for industrial use might be swapped for a consumer-grade unit. Specifications look similar on paper but performance differs significantly.

| Quality Risk | How to Detect | Potential Consequence |

|---|---|---|

| Counterfeit chips | Request lot numbers, verify with chip manufacturer | Sudden failures, safety hazards |

| Gray market sourcing | Ask for authorized distributor invoices | No warranty, inconsistent quality |

| Component downgrades | Compare specs to original quotes | Reduced performance, shorter lifespan |

| Incomplete testing | Request test reports with serial numbers | Hidden defects, field failures |

| Substitutions without notice | Require written approval for any changes | Compatibility issues, regulatory problems |

Verification Methods That Protect You

Request component traceability records. Legitimate suppliers maintain documentation showing each chip's origin, purchase date, and certification status. Our warehouse tracks every component with serial numbers linked to supplier invoices.

Ask for incoming inspection reports. Quality-focused manufacturers test components before assembly. We reject approximately 3% of incoming chips due to specification failures. Suppliers who skip this step pass problems to customers.

Blockchain and Modern Traceability

Some advanced suppliers now use blockchain for component tracking 8. This creates immutable records of each part's journey from manufacture to final assembly. While not yet universal, this technology represents the future of supply chain transparency.

For high-value orders, consider third-party testing. Independent labs can verify component authenticity and performance. The cost is small compared to field failure consequences.

Contract Protections

Include quality clauses in purchase agreements. Specify that substitutions require written approval. Define acceptable component sources. Set warranty terms that hold suppliers accountable for quality failures.

Our standard contracts include full replacement guarantees for component failures within the warranty period. We stand behind this because we control our supply chain quality.

Warning Signs of Quality Compromise

Watch for sudden price drops during shortages. If competitors quote significantly lower while component prices rise, question how they achieve this. Sometimes the answer involves quality shortcuts.

Ask directly about substitute policies. Honest suppliers explain their approach. Evasive answers suggest they make changes without customer knowledge.

What questions should I ask to evaluate my drone manufacturer's supply chain resilience and backup plans?

Our supply chain team learned hard lessons since 2020. We now maintain relationships with three suppliers for every critical component. Not every manufacturer invested in this resilience.

Ask suppliers about secondary sourcing agreements for critical chips. Inquire about inventory buffer policies and geographic diversification of component sources. Request information about modular designs that allow component swapping. Evaluate their ERP systems and demand forecasting capabilities. Resilient suppliers discuss these topics openly; unprepared ones deflect.

Essential Questions to Ask

Start with sourcing diversification. Ask: "For flight controllers, how many qualified suppliers do you maintain?" Single-source components create single points of failure. We qualify minimum two suppliers for every chip in our drones.

Inquire about geographic spread. Suppliers dependent entirely on one region face higher disruption risk. Our component network spans China, Taiwan, South Korea, and Europe.

Supply Chain Resilience Checklist

| Question to Ask | Strong Answer | Weak Answer |

|---|---|---|

| How many suppliers for critical chips? | 2-3 qualified suppliers per component | Single source or "our usual supplier" |

| What inventory buffer do you maintain? | 60-90 days for long-lead items | "We order as needed" |

| How do you handle component unavailability? | Documented substitution process | "We'll figure it out" |

| What regions do you source from? | Multiple countries/regions | Single country dependency |

| How do you forecast demand? | AI/ML predictive tools | Manual estimates |

| Do you offer modular designs? | Yes, with swap-capable subsystems | Integrated designs only |

Evaluating Backup Plans

Ask about their worst-case scenarios. Good suppliers have documented contingency plans. They know which components face highest risk and have specific mitigation strategies.

Request examples of past disruption handling. How did they manage during COVID lockdowns? What happened when the Suez Canal blocked? Their historical response predicts future performance.

The Modular Design Advantage

Modular drone designs allow component swapping when specific chips become unavailable. Our agricultural drones use standardized interfaces for cameras, sensors, and GPS units. When one sensor model faces shortages, we can substitute alternatives without redesigning entire systems.

This approach reduces your risk significantly. If your supplier offers modular designs, a chip shortage affects only one subsystem rather than your entire fleet.

Technology for Resilience

Ask about their technology infrastructure. Advanced suppliers use AI-powered demand forecasting. They predict component needs months ahead and adjust orders proactively.

ERP systems should provide real-time visibility. When our customers ask about order status, we show them exact production stage and component availability. This transparency builds trust and enables better planning on both sides.

Partnership Indicators

Strong suppliers view customers as partners rather than transactions. They share supply chain challenges openly. They offer early warnings when disruptions approach.

We notify customers immediately when component delays affect their orders. This sometimes means delivering bad news, but it allows customers to adjust their plans. Suppliers who hide problems until the last minute cause greater damage.

Nearshoring and Localization Trends

Many manufacturers now explore nearshoring options. Producing components closer to end markets reduces geopolitical risk and shipping delays. Ask if your supplier has localization plans for your region.

Some buyers benefit from suppliers with US or European assembly operations. While core components may still originate in Asia, local assembly adds flexibility and reduces customs complications.

Conclusión

The chip shortage tests every relationship between drone buyers and suppliers. Verification, documentation, and clear communication protect your business. Ask tough questions, demand transparency, and build partnerships with suppliers who plan for disruptions rather than react to them.

Notas al pie

1. Explains what a GPS module is and how it functions. ↩︎

2. Provides a comprehensive guide to drone flight controllers and their functions. ↩︎

3. Authoritative overview of the global chip shortage. ↩︎

4. Discusses the benefits and applications of agricultural drones in agribusiness. ↩︎

5. Authoritative explanation of LiDAR components and processing. ↩︎

6. Defines Enterprise Resource Planning (ERP) and its role in managing business activities. ↩︎

7. Authoritative government source on multispectral sensors. ↩︎

8. Discusses how blockchain improves supply chain transparency and traceability for components. ↩︎