When our production team ships agricultural drones worldwide, we often hear about buyers burned by suppliers who vanished overnight debt-to-equity ratios 1. Missing spare parts, abandoned warranties, and dead support lines—these nightmares keep procurement managers awake.

To evaluate agricultural drone supplier financial health, request audited financial statements covering three years, analyze cash flow stability, review debt ratios, assess R&D investment percentages, verify customer concentration levels, and examine operational metrics like fleet utilization rates and warranty claim histories.

This guide walks you through exactly what documents to request, which red flags to spot, and how to protect your business from supplier failures. Let’s dive into the practical frameworks that separate stable partners from risky bets.

What financial documents should I request to verify a drone manufacturer's long-term stability?

Our engineering team has seen partnerships collapse when suppliers couldn't fund basic operations. You find a great product, sign contracts, and then discover your supplier is drowning in debt. The problem starts with incomplete due diligence.

Request three years of audited financial statements including balance sheets, income statements, and cash flow statements. Ask for debt schedules, customer concentration reports, capital expenditure plans, and bank reference letters to build a complete picture of manufacturer stability.

The Core Financial Documents You Need

Start with the basics. Audited financial statements 2 carry more weight than internal reports. An independent auditor adds credibility. If a supplier only offers unaudited statements, that's your first warning sign.

The balance sheet tells you what they own versus what they owe. Look at current assets against current liabilities. A healthy supplier maintains a current ratio 3 above 1.5. Below 1.0 means they might struggle to pay bills.

The income statement reveals profitability trends. Don't just check if they're profitable—check if profitability is growing or shrinking. Declining margins over three years suggest trouble ahead.

Cash flow statements 4 matter most. A company can show profits on paper while bleeding cash. Operating cash flow must be positive. If they're funding operations through debt or equity raises, sustainability is questionable.

Document Request Checklist

| نوع المستند | What It Reveals | Red Flag Indicators |

|---|---|---|

| Audited Balance Sheet | Asset quality, debt levels | Current ratio below 1.0 |

| Income Statement (3 years) | Revenue trends, margin health | Declining gross margins |

| Cash Flow Statement | Actual cash generation | Negative operating cash flow |

| Debt Schedule | Repayment obligations | Large maturities within 12 months |

| Customer Concentration Report | Revenue dependency | Top 3 customers exceed 50% of revenue |

| Bank Reference Letter | Credit standing | Declined credit applications |

| Tax Returns | Reported vs. stated income | Major discrepancies |

How to Read These Documents

When reviewing balance sheets, focus on inventory turnover 5. Drones sitting in warehouses lose value fast. Technology moves quickly. High inventory relative to sales means unsold products and potential write-downs.

Check accounts receivable aging. If customers aren't paying, your supplier faces cash crunches. Receivables growing faster than revenue signals collection problems.

On the income statement, calculate gross margin percentage 6. Agricultural drone manufacturers should maintain margins above 25%. Service providers targeting spray operations need contribution margins around 71% to stay viable.

For cash flow, compare operating cash to net income. They should move together. If net income is positive but operating cash is negative, question the accounting. This gap often precedes financial distress.

خطوات التحقق

Don't accept documents at face value. Cross-reference supplier claims with public records. In China, you can check company registration databases. In the US, look for any litigation or liens.

Request bank references and actually call them. Ask about credit history and payment patterns. A supplier who hesitates to provide banking contacts may have something to hide.

If the supplier is venture-backed, research their investors. Strong institutional investors suggest proper financial oversight. Unknown investors or frequent ownership changes raise concerns.

How can I assess if my supplier has the capital to support ongoing R&D and spare parts availability?

In our factory, we dedicate significant resources to R&D because drone technology evolves rapidly. But not every manufacturer can afford this. Your supplier might cut corners on innovation to survive short-term, leaving you with obsolete equipment.

Evaluate R&D spending as a percentage of revenue—healthy suppliers invest 8-15% minimum. Review their technology roadmap, patent filings, spare parts inventory policies, and component sourcing strategies to confirm they can support your equipment throughout its lifecycle.

Why R&D Investment Matters

Agricultural drone technology changes every 18-24 months. Sensors improve. Flight controllers get smarter. Software platforms integrate better with farm management systems. A supplier stuck on old technology cannot serve you long-term.

Look for concrete R&D commitments. Ask what percentage of revenue goes to development. R&D investment 7 Request their product roadmap for the next three years. Check patent filings—active patent applications show innovation investment.

Suppliers without R&D budgets rely on copying competitors. This approach fails when regulations change or customers demand new features. You end up with equipment that can't adapt.

Spare Parts Capital Requirements

Spare parts availability requires capital tied up in inventory. Many suppliers minimize parts inventory to preserve cash. This helps their balance sheet but hurts your operations when something breaks.

Ask about parts stocking policies. How many units of each critical component do they keep? What's their reorder point? How long does it take to manufacture or source replacement parts?

Request a spare parts price list with availability guarantees. Include contractual terms requiring minimum inventory levels. Suppliers who refuse likely can't afford the commitment.

Assessing Capital Adequacy

| Capital Indicator | Healthy Range | Warning Zone |

|---|---|---|

| R&D as % of Revenue | 8-15% | Below 5% |

| Spare Parts Inventory Value | 3-6 months of demand | Below 1 month |

| Cash Reserves | 6+ months operating costs | Below 3 months |

| Working Capital Ratio | Above 1.5 | Below 1.0 |

| Debt Service Coverage | Above 2.0x | Below 1.2x |

Component Sourcing Strategy

Where does your supplier get their parts? A diversified supply chain 8 protects against shortages. Over-reliance on single sources creates risk.

Ask about their motor suppliers, battery sources, and controller manufacturers. Do they have backup suppliers qualified? How do they handle component shortages?

Geopolitical factors matter. Trade tensions and tariffs can disrupt supply chains overnight. Suppliers with localized production or multiple sourcing regions offer better security.

Technology Roadmap Evaluation

A credible roadmap includes specific timelines and features. Vague promises about "future improvements" mean nothing. Ask for documented plans with milestones.

Compare their roadmap against industry trends. Are they investing in AI-driven analytics? Autonomous flight capabilities? Advanced sensor integration? Suppliers ignoring these trends will fall behind.

Check if they participate in industry conferences and publish technical content. Active industry engagement indicates commitment to advancement.

What red flags should I look for to ensure my drone partner won't face financial failure during our contract?

When we onboard new distribution partners, we share our financial metrics openly. Transparency builds trust. But many suppliers hide problems until it's too late. Your contract becomes worthless when they close their doors.

Watch for declining revenue trends, negative operating cash flow, high debt-to-equity ratios exceeding 2:1, customer concentration above 50% in top three accounts, frequent management changes, delayed financial reporting, and growing accounts receivable that indicate collection problems.

Balance Sheet Red Flags

Inventory buildup signals trouble. If inventory grows faster than sales for two consecutive quarters, they're producing drones nobody wants. This ties up cash and leads to write-downs.

Watch accounts receivable aging. Receivables over 90 days old suggest customers aren't paying. This creates cash flow gaps that can spiral quickly.

Deferred revenue declining means fewer advance bookings. In seasonal agricultural markets, pre-season commitments indicate demand. Falling deferred revenue suggests customers are looking elsewhere.

Goodwill impairments reveal failed acquisitions. When a supplier writes down goodwill, their previous purchases underperformed. This questions management judgment and capital allocation.

Income Statement Warning Signs

Gross margins should remain stable or improve. Declining gross margins over three years indicate pricing pressure, cost inflation, or operational inefficiency. None of these are good.

Operating expenses growing faster than revenue is unsustainable. Efficient suppliers maintain expense ratios. Bloated overhead eventually forces cuts that hurt service quality.

One-time charges and restructuring costs often mask ongoing problems. A single restructuring might be strategic. Repeated charges suggest management is struggling to fix fundamental issues.

Cash Flow Concerns

| علامة تحذير | ما الذي يعنيه ذلك | الإجراء المطلوب |

|---|---|---|

| Negative operating cash flow | Core business loses money | Request detailed explanation |

| CapEx exceeding operating cash | Unsustainable growth | Verify funding sources |

| Increasing reliance on financing | Operations can't self-fund | Assess debt covenants |

| Declining free cash flow | Less money for R&D and parts | Evaluate service commitment |

| Accounts payable stretching | Suppliers not getting paid | Check their supply chain risk |

Operational Warning Signs

High staff turnover matters. Engineers and pilots leaving indicate internal problems. These departures take institutional knowledge and suggest poor working conditions or uncertain futures.

Delayed delivery patterns often precede financial distress. When suppliers can't meet commitments, cash problems usually drive the failure. Track their on-time delivery rate carefully.

Sudden price drops can signal desperation. A supplier slashing prices might be chasing cash at any cost. This strategy sacrifices margin and accelerates decline.

Due Diligence Investigation Steps

Check litigation records. Lawsuits from employees, suppliers, or customers indicate disputes that drain resources. Patterns of litigation suggest management problems.

Research their banking relationships. Multiple bank changes or difficulty securing credit lines point to financial instability.

Talk to their other customers. Ask about recent service experiences. Declining service quality often precedes financial problems as companies cut costs.

Monitor their hiring activity. A supplier aggressively hiring while losing money might be funded growth. A supplier laying off while claiming stability is hiding problems.

How does a supplier's financial health impact their ability to handle my large-scale OEM and customization requests?

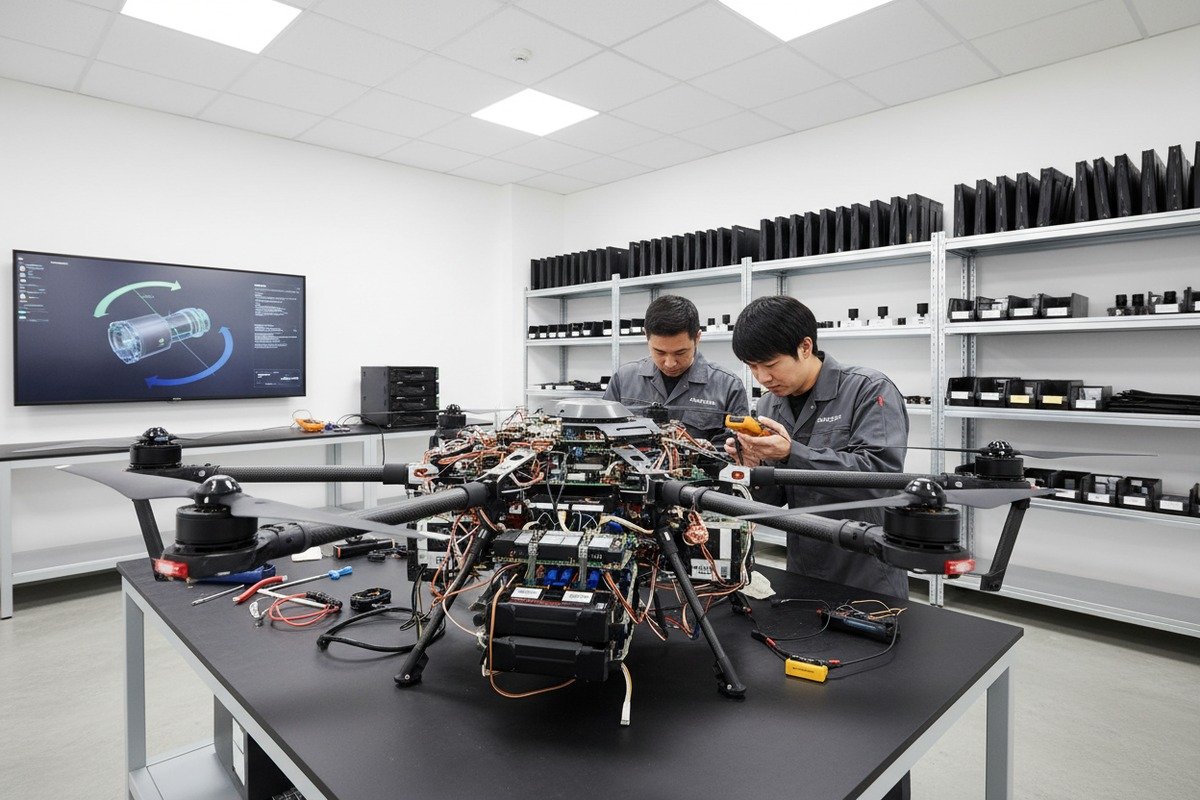

Our team handles customization projects regularly. These require upfront engineering investment, specialized tooling, and dedicated production capacity. Only financially stable suppliers can commit these resources without cutting corners on your order.

Financially healthy suppliers can invest in dedicated engineering teams, custom tooling, inventory buffers, and quality control systems that OEM projects require. Cash-constrained suppliers cut corners, delay deliveries, and may abandon customization commitments when standard product demand competes for limited resources.

Capital Requirements for OEM Projects

Custom drone development requires significant upfront investment. Engineering hours, prototype iterations, specialized components, and dedicated testing all cost money before any revenue arrives.

A supplier needs working capital to fund this gap. Projects spanning 6-12 months require capital reserves that cash-strapped companies don't have. They accept your order, start work, and then struggle to finish when cash runs low.

How Financial Health Affects Your Project

| مرحلة المشروع | Healthy Supplier Behavior | Financially Stressed Behavior |

|---|---|---|

| الهندسة | Dedicated team, thorough design | Shared resources, rushed design |

| النماذج الأولية | Multiple iterations until right | Minimal testing, corner-cutting |

| Tooling | Custom tooling investment | Adaptation of existing tools |

| الإنتاج | Dedicated line capacity | Competition with standard products |

| مراقبة الجودة | Rigorous testing protocols | Abbreviated QC to save time |

| Support | Engineering resources available | Limited post-delivery assistance |

Evaluating Customization Capacity

Ask about their engineering team structure. How many engineers do they employ? What's their experience with custom projects? Request case studies of similar customization work.

Check their production flexibility. Can they dedicate capacity to your project without disrupting other customers? A supplier running at 95% capacity has no room for your custom work.

Review their supplier relationships for custom components. Do they have qualified sources for specialized parts? Long lead times on components delay your entire project.

Contract Protections for OEM Projects

Financial health enables suppliers to accept meaningful contract terms. Healthy suppliers agree to performance bonds, milestone payments tied to deliverables, and penalty clauses for delays.

Request phased payments linked to specific milestones. Never pay more than 30% upfront. Structure payments around prototype approval, production start, and delivery completion.

Include intellectual property protections. Your custom designs belong to you. Financially desperate suppliers might sell your designs to competitors or use them for other customers.

Long-Term Support Considerations

OEM products need ongoing support. Custom firmware updates, specialized spare parts, and technical assistance require supplier commitment beyond initial delivery.

Evaluate their service infrastructure. Do they have trained technicians who understand your custom configuration? Can they stock your specialized spare parts?

Consider escrow arrangements for critical documentation. If the supplier fails, you need access to design files, firmware source code, and manufacturing specifications to find alternative support.

Assessing True Production Capability

Factory visits reveal more than documents. Request timestamped video tours showing current production. Verify inventory levels match claims. Check equipment age and maintenance.

Talk to their production managers. Ask about capacity utilization, quality rejection rates, and lead time accuracy. Front-line staff often share realities that sales teams hide.

Review their quality certifications. ISO 9001 certification 9 indicates systematic quality processes. Ask for recent audit reports and corrective action records.

الخاتمة

Evaluating supplier financial health protects your business from costly disruptions. Request complete documentation, analyze key metrics carefully, watch for warning signs, and structure contracts that protect your interests. Your long-term sourcing success depends on partners who can deliver today and support you tomorrow.

الحواشي

1. Defines the debt-to-equity ratio as a leverage ratio indicating the proportion of debt versus equity financing. ︎

2. Explains what audited financial statements are and their importance for financial health and credibility. ︎

3. Authoritative definition from Wikipedia. ︎

4. Provides a detailed explanation of cash flow statements, their components, and significance for business financial strength. ︎

5. Describes inventory turnover as a measure of efficiency in managing inventory and its impact on capital. ︎

6. Explains how to calculate and interpret gross margin percentage as a key indicator of financial performance. ︎

7. Authoritative definition of R&D intensity for an enterprise from Eurostat, European Commission. ︎

8. Explains the benefits of supply chain diversification for resilience, risk reduction, and agility in business. ︎

9. Describes ISO 9001 as an international standard for quality management systems and its certification requirements. ︎